- September 23, 2022

- Posted by: admin

- Category: Bookkeeping

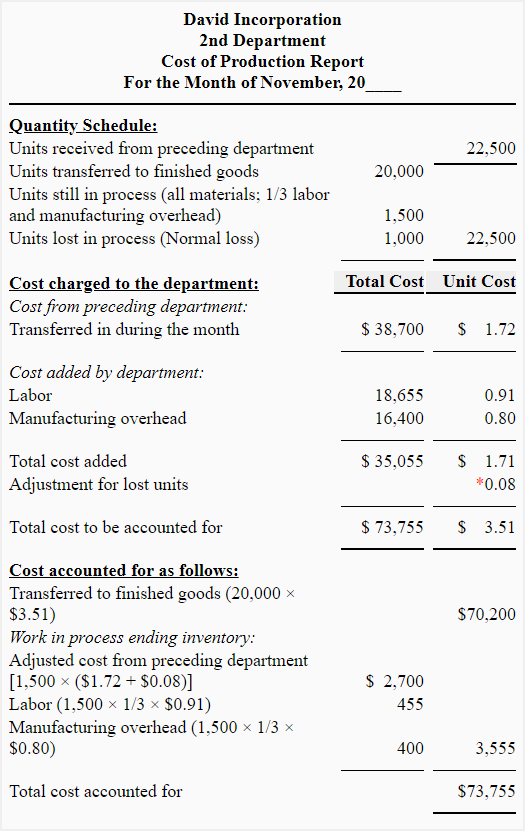

Notice that each section of thisreport corresponds with one of the four steps described earlier. Weprovide references to the following illustrations so you can reviewthe detail supporting calculations. Understanding how business production costs work is a critical part of any type of company. It’s going to impact everything from the suppliers you use to the type of product or service you produce.

Maintenance Costs

- But on the flip side, a software company might have different production costs.

- It’s also important to recognize that simply reducing production costs won’t necessarily generate more profit.

- With 750 started in January, the other 2,250 were started and completed in February.

- For example, management could use the report to identify areas where costs are high and to take steps to reduce costs.

- An example of how to use Excel to prepare a production cost report follows.

Basically, it’s how much it costs you to produce a single product or service, or the cost per unit. When you add together both the variable costs and fixed costs they’re going to equal the total cost. Essentially, this is the total cost incurred for production including any changes to production volume.

What Are Production Costs?

The beginning inventory of 750 plus the 3,250 pie shells worth of materials placed into production during the month gives us 4,000 total units to account for. Production volume measures how many units are manufactured over a specific period. This is a fundamental benchmark for manufacturing efficiency and helps production managers understand the total output the factory can produce. The production volume to be manufactured by an organization should be determined by its production budget. You can determine production costs by adding together any labor costs and direct material costs.

Cost Accounting

You have goals to provide the best possible product or service to your customers. Preparing the Production Cost Report for subsequent departments is similar to preparing the report for the first department, with the addition of a column for costs transferred in. In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory.

Capacity Utilization

When using information from the production cost report, managersmust be careful not to assume that all production costs arevariable costs. The CEO of Desk Products, Inc., Ann Watkins, wastold that the Assembly department cost for each desk totaled $62for the month of May (from Figure 4.9, step 3). However, if thecompany produces more or fewer units than were produced in May, theunit cost will change. This is because the $62 unit cost includesboth variable and fixed costs (see Chapter 5 for a detaileddiscussion of fixed and variable costs).

This formula can be a great way to find out how much it costs to produce a single unit, which can allow you to break down your production costs further. It’s also important to recognize that simply reducing production costs won’t necessarily generate more profit. There’s always a need to have certain raw materials and labor to ensure your product or service is high-quality. Factory overhead’ is a term used in business management for expenses related specifically with the cost of maintaining the premises, plant and equipment within a factory. Factory overhead costs may include items such as electricity, heat, power, rent, Depreciation on machines or even the supervisor’s salary. Costs not included with factory overhead are selling costs and general administrative expenses.

This flexible template can respond to demand fluctuations and helps avoid inventory stockouts. ProjectManager has over 100 free project management templates for Excel and Word that can be downloaded right now to help with every project phase. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid.

Production downtime refers to the time a factory’s assembly lines aren’t operating. By reducing the downtime, production managers can increase the productivity of their manufacturing efforts. Production managers use the production report to monitor production to increase efficiency. While a production report can cover gambling winnings a wide range of metrics, generally, it has a core set of KPIs. Production reporting is also used to identify weaknesses that can be addressed and resolved to have production run more efficiently. Some issues that a production report can capture include bottlenecks, unplanned downtime and poor machine utilization.

This report is used to determine the cost of goods sold and to determine the value of inventory. The cost of production report is commonly used in process costing systems where goods are produced through a series of processes and not produced individually. From the accounting records, we see that total direct materials used in January by the baking/packaging department were $600, and direct labor and manufacturing overhead totaled $4,100. We divided those amounts by the related Equivalent Units to come up with a cost per EU. From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640. The company had 750 shells in process at the close of business on January 31.

Use our secure timesheets to ensure that labor costs align with the budget. Not only do they streamline payroll, but they provide visibility into how far each team member is in completing their tasks. For a high-level overview of production costs, use the real-time dashboard. Scheduling production, planning a budget and allocating resources only sets up manufacturing for success.

However it is recommended to use job order costing for more than one product. Doing proper calculations will help with decision-making and increase business sales. You can find new opportunities and areas for improvement so you can operate at an optimal level. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University.